Contact Us

office@taxsherpa.com

(678) 944-8367

Follow Us:

Our Blogs

On our blogs you will find our Tax Sherpa Stories series as well as additional posts covering all manner of tax topics. Some items are timely as there are multiple tax filing dates throughout the year and some items are important larger concepts.

OBBBA SALT Deduction Changes: What Taxpayers Must Know

Learn how the OBBBA expands SALT deductions, new income phaseouts, planning strategies, and what solopreneurs and small business owners should do now. ...more

tax concepts

November 13, 2025•3 min read

The Return of Itemized Deductions: How Tax Strategy is Shifting for Homeowners in 2025

Discover how rising mortgage costs and new tax laws make itemizing deductions smarter in 2025. Learn who benefits and how to plan for bigger savings. ...more

tax concepts

October 23, 2025•6 min read

Understanding IRS Penalties: 4 Costly Types & How to Avoid

Understand the 4 IRS penalties: underpayment, failure to file, failure to pay, and interest plus safe-harbor rules and proven tips to avoid or abate them. ...more

tax concepts

October 13, 2025•21 min read

What to Do If You Win the Lottery | Tax Strategy Tips

What to do after a big lottery win. Avoid tax traps, protect your wealth, and turn a windfall into generational security with smart tax strategies. ...more

tax concepts

September 06, 2025•3 min read

One Big Beautiful Bill Passes!

Decode the One Big Beautiful Bill (OB3): key 2025 tax breaks, credits, and compliance tips every small business owner needs before the new rules kick in. ...more

tax concepts

July 07, 2025•3 min read

IRS Online Payments Going Mandatory – What Solopreneurs Must Know

The IRS is phasing out paper checks by 2025. Learn how to manage IRS online payments, direct pay options, and avoid refund delays or fraud. ...more

tax concepts

June 06, 2025•3 min read

🧠 Solo 401(k) for S-Corp Owners: Rules, Limits & Setup Guide

Learn how to set up a Solo 401(k) for your S-Corp. Explore rules, contribution limits, Roth options, and the best retirement plans for owner-employees. ...more

tax concepts

May 09, 2025•3 min read

The $150,000 Tax Cut Proposal: Will It Save You Money or Wreck the Economy?

A new tax proposal promises to eliminate federal income taxes for those earning under $150,000. But is it financially viable? Discover the hidden costs, payroll tax realities, and economic impact of t... ...more

tax concepts

March 15, 2025•6 min read

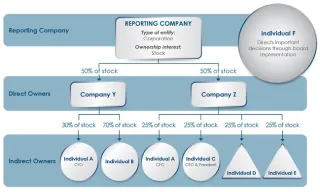

The BOI Reporting Rollercoaster: A Cautionary Tale for Small Businesses

🚨 BOI Reporting Rollercoaster: What Just Happened? 🎢 Small business owners, buckle up! The Beneficial Ownership Information (BOI) reporting saga has taken wild twists and turns—court battles, shift... ...more

tax concepts

March 03, 2025•4 min read

Think Twice Before Filing Your 2024 Taxes

Major tax changes could be coming in 2025! Find out why waiting to file your 2024 taxes might be the smartest financial move you make this year. ...more

tax concepts

January 23, 2025•7 min read

Marriage for Tax Purposes

What if I told you someone out there is actively looking for a spouse—not for love, but to save nearly half a million dollars in taxes? Yep, this isn’t the plot of a rom-com, but a real post I came ac... ...more

tax concepts

December 11, 2024•4 min read

BOI Reporting Update (Again)

The courts have handed the Treasury another loss in the beneficial ownership reporting saga. ...more

tax concepts

December 09, 2024•2 min read

Frequently Asked Questions

Q:

What's the difference between tax advisory and just filing my taxes?

Filing your taxes each year is a necessary task, but it is always backwards looking. Tax advisory works with you throughout the year to make sure that you are on the right track when it comes to your taxes and have strategies in place to save money now.

Q:

I've heard about tax write-offs for small businesses. What exactly can I write off, and how does it benefit my business?

Tax write-offs, also known as tax deductions, are expenses that a business incurs that can be subtracted from its revenue to reduce the amount of taxable income. Common write-offs include office supplies, mileage, rent for a business location, and advertising expenses, among many others. By writing off legitimate business expenses, you can significantly reduce your taxable income, which can lead to a lower tax bill. It's essential, however, to maintain proper records and ensure that the expenses are truly business-related.

Q:

What's the difference between a tax deduction and a tax credit?

A tax deduction reduces the amount of your income that is subject to taxation, which in turn can lower your tax liability. Common deductions include expenses like mortgage interest, student loan interest, and business expenses. A tax credit, on the other hand, is a direct reduction of your tax bill. This means if you owe $1,000 in taxes and have a $200 tax credit, your tax due would be reduced to $800. Some popular credits include the Child Tax Credit, the Earned Income Tax Credit, and credits for energy-efficient home improvements.

Q:

I'm thinking of hiring an independent contractor instead of an employee. Are there different tax implications for each?

Yes, there are significant tax differences between hiring an employee and an independent contractor. When you hire an employee, you're responsible for withholding federal and possibly state income taxes, Social Security, and Medicare taxes from their paychecks. You also typically pay unemployment taxes on wages paid to employees. Independent contractors, on the other hand, are responsible for their own taxes. As a business owner, you'd provide them with a Form 1099-NEC (if you pay them $600 or more during the year) instead of a W-2, and they would be responsible for their own self-employment taxes. It's important to correctly classify your workers, as misclassifying can lead to penalties.

Get in touch with us

Have questions? Use the form here and one of our knowledgable staff will get back to you as soon as possible.

(678) 944-8367

office@taxsherpa.com

2302 Parklake Dr NE Ste 675

Monday - Friday, 10:00 am - 5:00 pm

Send us a message

Follow Us

Follow Us

Disclaimer: The content presented on this website is intended for informational purposes only and is not tailored to the needs of any specific individual or entity. It should not be considered as financial, investment, or tax advice. The information provided is general in nature and does not account for individual circumstances or financial positions. Before making any financial or tax-related decisions, we strongly advise consulting with a qualified professional who can provide guidance tailored to your individual situation. All information on this site is provided in good faith, but we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the site. Use of this site and reliance on its content is solely at your own risk.

Services

More

Contact Us

office@taxsherpa.com

(678) 944-8367

2302 Parklake Dr NE Ste 675

Atlanta, GA 30345

Monday - Friday, 10:00 am - 5:00 pm

© Copyright 2026. Online Tax Solutions Group LLC dba Tax Sherpa. All rights reserved.