Contact Us

office@taxsherpa.com

(678) 944-8367

Follow Us:

Our Blogs

On our blogs you will find our Tax Sherpa Stories series as well as additional posts covering all manner of tax topics. Some items are timely as there are multiple tax filing dates throughout the year and some items are important larger concepts.

Analyzing Trump's Social Security Tax Plan: My Take on the Financial Times' $1.5 Trillion Claim

Hey everyone! So, I was enjoying my Saturday morning when I stumbled upon a headline that got me thinking: "Trump's Social Security Tax Plan Would Cost $1.5 Trillion: Analysis." This bold claim came from the Financial Times and was shared on MSN.com. Given my background in tax advisory, I had to dig deeper and see if this number really holds up.

Overview of Trump's Social Security Proposal

Let's start with the basics. Trump's proposal, shared on his social media platform, suggested that seniors shouldn't have to pay taxes on their Social Security benefits. It sounds pretty appealing, right? However, fiscal experts quickly criticized the idea, arguing that it would be incredibly expensive and not really help low-income beneficiaries. Plus, it could make Social Security even less stable.

Dissecting the Media Claims

The headline screamed about a $1.5 trillion cost over the next decade if this plan were implemented. But when I looked into the details, the math just didn’t add up. It seemed like there were some significant errors in their analysis.

Understanding Social Security Financing

To make sense of this, let's talk about how Social Security is funded. Essentially, it's financed through a payroll tax. If you’re an employee, you and your employer each pay 6.2% of your wages, totaling 12.4%. If you’re self-employed, you cover the whole 12.4% yourself. In 2023, Social Security collected around $1.35 trillion from payroll taxes, benefit taxation, and interest.

Analyzing the Numbers

Now, let’s break down that $1.5 trillion claim. Social Security’s revenue from taxing benefits in 2023 was about $51 billion. Over ten years, that totals $510 billion—not even close to $1.5 trillion. Even with an expected increase in beneficiaries, the math still falls short. Projections suggest a 10% rise in beneficiaries over the next decade, which would only slightly increase the tax revenue, but nowhere near the trillion-dollar mark.

Implications of Eliminating Social Security Tax on Benefits

Currently, Social Security benefits are taxed based on your income level, with up to 85% of benefits being taxable. For example, if you get $10,000 in benefits and are in the 22% tax bracket, you’d pay income tax on 85% of that amount, which totals $1,870. This taxation effectively reduces the net benefits you receive.

Projections and Future Impact

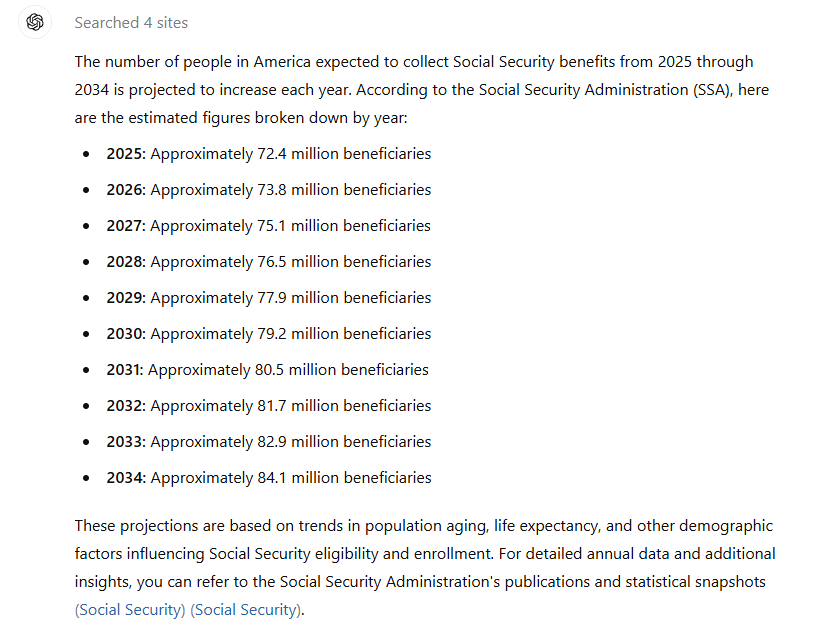

The Financial Times article didn’t accurately factor in the projected increase in beneficiaries. Social Security data shows the number of beneficiaries is expected to grow from 72 million to 84 million over the next decade. This would boost the annual tax revenue from $51 billion to around $55 billion. Even with this growth, it doesn’t add up to $1.5 trillion.

Long-Term Viability of Social Security

According to the Social Security Trustees’ report, the program is projected to become insolvent by 2034 if no changes are made. Eliminating the tax on benefits could push this date up by about six months. The program already faces a funding shortfall, and reducing its revenue would make things worse. The Trustees’ report underscores that Social Security isn't sustainable in its current form, and we need to make some changes to ensure it can keep going.

Possible Solutions and Adjustments

So, what can be done to fix this? Here are a few ideas:

Raising the Payroll Tax Rate: Increasing the Social Security tax rate from 12.4% to a higher percentage.

Removing the Income Cap: Right now, only income up to $160,200 is subject to Social Security tax. Removing this cap would increase revenue.

Adjusting Benefits: Gradual changes to the full retirement age or benefit calculations could help reduce costs.

These adjustments will need careful consideration and political will, but they’re crucial for the program’s sustainability.

But that doesn't mean you need to paying more than you need towards Social Security or any other government program. If you want to discuss how you can potentially pay less on your taxes, book a call with one of our tax experts.

Conclusion

In conclusion, the claim that eliminating Social Security taxes on benefits would cost $1.5 trillion over the next decade doesn't hold up under scrutiny. While the idea might have political appeal, it’s important to dig into the numbers and understand the long-term implications. Social Security is a critical program that needs sustainable funding solutions to keep serving future generations.

I’d love to hear your thoughts and comments on this analysis. Staying informed and critically evaluating media claims is essential for making sound financial decisions. Let’s keep the conversation going and work towards sustainable solutions for our Social Security system.

References:

Frequently Asked Questions

Q:

What's the difference between tax advisory and just filing my taxes?

Filing your taxes each year is a necessary task, but it is always backwards looking. Tax advisory works with you throughout the year to make sure that you are on the right track when it comes to your taxes and have strategies in place to save money now.

Q:

I've heard about tax write-offs for small businesses. What exactly can I write off, and how does it benefit my business?

Tax write-offs, also known as tax deductions, are expenses that a business incurs that can be subtracted from its revenue to reduce the amount of taxable income. Common write-offs include office supplies, mileage, rent for a business location, and advertising expenses, among many others. By writing off legitimate business expenses, you can significantly reduce your taxable income, which can lead to a lower tax bill. It's essential, however, to maintain proper records and ensure that the expenses are truly business-related.

Q:

What's the difference between a tax deduction and a tax credit?

A tax deduction reduces the amount of your income that is subject to taxation, which in turn can lower your tax liability. Common deductions include expenses like mortgage interest, student loan interest, and business expenses. A tax credit, on the other hand, is a direct reduction of your tax bill. This means if you owe $1,000 in taxes and have a $200 tax credit, your tax due would be reduced to $800. Some popular credits include the Child Tax Credit, the Earned Income Tax Credit, and credits for energy-efficient home improvements.

Q:

I'm thinking of hiring an independent contractor instead of an employee. Are there different tax implications for each?

Yes, there are significant tax differences between hiring an employee and an independent contractor. When you hire an employee, you're responsible for withholding federal and possibly state income taxes, Social Security, and Medicare taxes from their paychecks. You also typically pay unemployment taxes on wages paid to employees. Independent contractors, on the other hand, are responsible for their own taxes. As a business owner, you'd provide them with a Form 1099-NEC (if you pay them $600 or more during the year) instead of a W-2, and they would be responsible for their own self-employment taxes. It's important to correctly classify your workers, as misclassifying can lead to penalties.

Get in touch with us

Have questions? Use the form here and one of our knowledgable staff will get back to you as soon as possible.

(678) 944-8367

office@taxsherpa.com

2302 Parklake Dr NE Ste 675

Monday - Friday, 10:00 am - 5:00 pm

Send us a message

Follow Us

Follow Us

Disclaimer: The content presented on this website is intended for informational purposes only and is not tailored to the needs of any specific individual or entity. It should not be considered as financial, investment, or tax advice. The information provided is general in nature and does not account for individual circumstances or financial positions. Before making any financial or tax-related decisions, we strongly advise consulting with a qualified professional who can provide guidance tailored to your individual situation. All information on this site is provided in good faith, but we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the site. Use of this site and reliance on its content is solely at your own risk.

Services

More

Contact Us

office@taxsherpa.com

(678) 944-8367

2302 Parklake Dr NE Ste 675

Atlanta, GA 30345

Monday - Friday, 10:00 am - 5:00 pm

© Copyright 2025. Online Tax Solutions Group LLC dba Tax Sherpa. All rights reserved.