Contact Us

office@taxsherpa.com

(678) 944-8367

Follow Us:

Our Blogs

On our blogs you will find our Tax Sherpa Stories series as well as additional posts covering all manner of tax topics. Some items are timely as there are multiple tax filing dates throughout the year and some items are important larger concepts.

BOI Reporting Update

What is the Beneficial Ownership Information (BOI) Report?

As I've written about before in this post on the BOI Report,

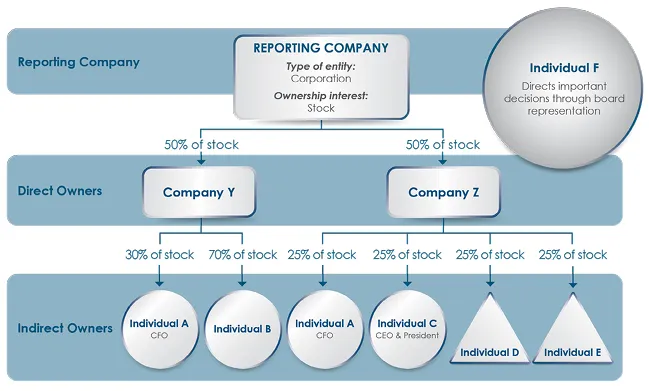

The Beneficial Ownership Information (BOI) Report, as mandated by the Corporate Transparency Act (CTA), is a new federal requirement for certain U.S. entities to disclose detailed information about their beneficial owners. A "beneficial owner" is defined as an individual who directly or indirectly owns or controls at least 25% of the company or exercises substantial control over it. The goal of the BOI Report is to enhance corporate transparency and prevent the use of shell companies for illicit purposes, such as money laundering, tax evasion, and financing terrorism.

The report must include:

Full name, date of birth, and address of each beneficial owner.

A unique identifying number from an acceptable ID (e.g., driver's license, passport).

Entities subject to the CTA need to file the BOI Report with FinCEN (Financial Crimes Enforcement Network). This applies to most corporations, limited liability companies (LLCs), and other entities formed in the U.S. or registered to do business here, with exceptions for certain large or regulated businesses.

What is the current legal status of BOI Reporting?

A lawsuit was brought against the Department of the Treasury in Federal court at the beginning of 2024 in National Small Business United v. Yellen. In that case, the judge held that the BOI reporting requirement is unconstitutional.

I've made a copy of the decision available here.

The real relevant portion is the conclusion starting on page 52:

IV. CONCLUSION The Corporate Transparency Act is unconstitutional because it cannot be justified as an exercise of Congress’ enumerated powers. This conclusion makes it unnecessary to decide whether the CTA violates the First, Fourth, and Fifth Amendments. Case 5:22-cv-01448-LCB Document 51 Filed 03/01/24 Page 52 of 53 53 For these reasons, the Plaintiffs are entitled to summary judgment as a matter of law. The Court GRANTS the Plaintiffs’ Motion for Summary Judgment (Doc. 23) and DENIES the Defendant’s Motion to Dismiss or Alternative Cross Motion for Summary Judgment (Doc. 24). The Court will separately issue a final judgment. DONE and ORDERED March 1, 2024

So the government lost the case, and the law was declared unconstitutional.

The government is appealing this decision.

The government also claims that this decision only applies to the plaintiffs in the case (members of National Small Business United) and does not apply to everyone else.

I am no Constitutional scholar, but is generally not how the Constitution works.

What should I as a business owner do?

At Tax Sherpa, we do not offer legal counsel. You should consult with your attorney as to whether you wish to comply or not given the legal uncertainty of this reporting requirement.

If you do wish to file your BOI report, watch the video in my post on Navigating the Corporate Transparency Act: A Comprehensive Guide by Tax Sherpa and it will show you how to fill out the forms.

Frequently Asked Questions

Q:

What's the difference between tax advisory and just filing my taxes?

Filing your taxes each year is a necessary task, but it is always backwards looking. Tax advisory works with you throughout the year to make sure that you are on the right track when it comes to your taxes and have strategies in place to save money now.

Q:

I've heard about tax write-offs for small businesses. What exactly can I write off, and how does it benefit my business?

Tax write-offs, also known as tax deductions, are expenses that a business incurs that can be subtracted from its revenue to reduce the amount of taxable income. Common write-offs include office supplies, mileage, rent for a business location, and advertising expenses, among many others. By writing off legitimate business expenses, you can significantly reduce your taxable income, which can lead to a lower tax bill. It's essential, however, to maintain proper records and ensure that the expenses are truly business-related.

Q:

What's the difference between a tax deduction and a tax credit?

A tax deduction reduces the amount of your income that is subject to taxation, which in turn can lower your tax liability. Common deductions include expenses like mortgage interest, student loan interest, and business expenses. A tax credit, on the other hand, is a direct reduction of your tax bill. This means if you owe $1,000 in taxes and have a $200 tax credit, your tax due would be reduced to $800. Some popular credits include the Child Tax Credit, the Earned Income Tax Credit, and credits for energy-efficient home improvements.

Q:

I'm thinking of hiring an independent contractor instead of an employee. Are there different tax implications for each?

Yes, there are significant tax differences between hiring an employee and an independent contractor. When you hire an employee, you're responsible for withholding federal and possibly state income taxes, Social Security, and Medicare taxes from their paychecks. You also typically pay unemployment taxes on wages paid to employees. Independent contractors, on the other hand, are responsible for their own taxes. As a business owner, you'd provide them with a Form 1099-NEC (if you pay them $600 or more during the year) instead of a W-2, and they would be responsible for their own self-employment taxes. It's important to correctly classify your workers, as misclassifying can lead to penalties.

Get in touch with us

Have questions? Use the form here and one of our knowledgable staff will get back to you as soon as possible.

(678) 944-8367

office@taxsherpa.com

2302 Parklake Dr NE Ste 675

Monday - Friday, 10:00 am - 5:00 pm

Send us a message

Follow Us

Follow Us

Disclaimer: The content presented on this website is intended for informational purposes only and is not tailored to the needs of any specific individual or entity. It should not be considered as financial, investment, or tax advice. The information provided is general in nature and does not account for individual circumstances or financial positions. Before making any financial or tax-related decisions, we strongly advise consulting with a qualified professional who can provide guidance tailored to your individual situation. All information on this site is provided in good faith, but we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of any information on the site. Use of this site and reliance on its content is solely at your own risk.

Services

More

Contact Us

office@taxsherpa.com

(678) 944-8367

2302 Parklake Dr NE Ste 675

Atlanta, GA 30345

Monday - Friday, 10:00 am - 5:00 pm

© Copyright 2026. Online Tax Solutions Group LLC dba Tax Sherpa. All rights reserved.