BOI Reporting Update

What is the Beneficial Ownership Information (BOI) Report?

As I've written about before in this post on the BOI Report,

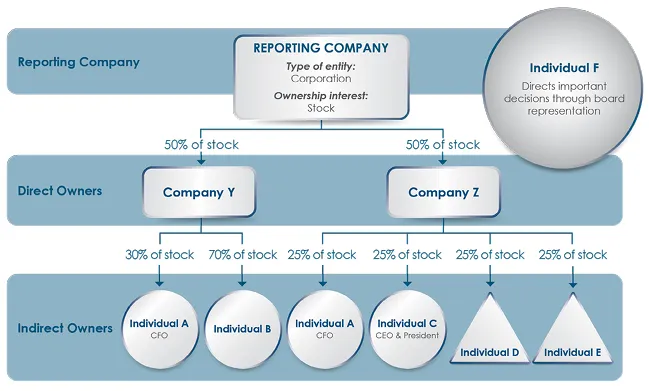

The Beneficial Ownership Information (BOI) Report, as mandated by the Corporate Transparency Act (CTA), is a new federal requirement for certain U.S. entities to disclose detailed information about their beneficial owners. A "beneficial owner" is defined as an individual who directly or indirectly owns or controls at least 25% of the company or exercises substantial control over it. The goal of the BOI Report is to enhance corporate transparency and prevent the use of shell companies for illicit purposes, such as money laundering, tax evasion, and financing terrorism.

The report must include:

Full name, date of birth, and address of each beneficial owner.

A unique identifying number from an acceptable ID (e.g., driver's license, passport).

Entities subject to the CTA need to file the BOI Report with FinCEN (Financial Crimes Enforcement Network). This applies to most corporations, limited liability companies (LLCs), and other entities formed in the U.S. or registered to do business here, with exceptions for certain large or regulated businesses.

What is the current legal status of BOI Reporting?

A lawsuit was brought against the Department of the Treasury in Federal court at the beginning of 2024 in National Small Business United v. Yellen. In that case, the judge held that the BOI reporting requirement is unconstitutional.

I've made a copy of the decision available here.

The real relevant portion is the conclusion starting on page 52:

IV. CONCLUSION The Corporate Transparency Act is unconstitutional because it cannot be justified as an exercise of Congress’ enumerated powers. This conclusion makes it unnecessary to decide whether the CTA violates the First, Fourth, and Fifth Amendments. Case 5:22-cv-01448-LCB Document 51 Filed 03/01/24 Page 52 of 53 53 For these reasons, the Plaintiffs are entitled to summary judgment as a matter of law. The Court GRANTS the Plaintiffs’ Motion for Summary Judgment (Doc. 23) and DENIES the Defendant’s Motion to Dismiss or Alternative Cross Motion for Summary Judgment (Doc. 24). The Court will separately issue a final judgment. DONE and ORDERED March 1, 2024

So the government lost the case, and the law was declared unconstitutional.

The government is appealing this decision.

The government also claims that this decision only applies to the plaintiffs in the case (members of National Small Business United) and does not apply to everyone else.

I am no Constitutional scholar, but is generally not how the Constitution works.

What should I as a business owner do?

At Tax Sherpa, we do not offer legal counsel. You should consult with your attorney as to whether you wish to comply or not given the legal uncertainty of this reporting requirement.

If you do wish to file your BOI report, watch the video in my post on Navigating the Corporate Transparency Act: A Comprehensive Guide by Tax Sherpa and it will show you how to fill out the forms.